By BloggerKhan

Posted in Reviews and Comparisions | Tags : apr, fixed cost loans, loans, merchant loans, paypal, paypal loans, what is, working capital

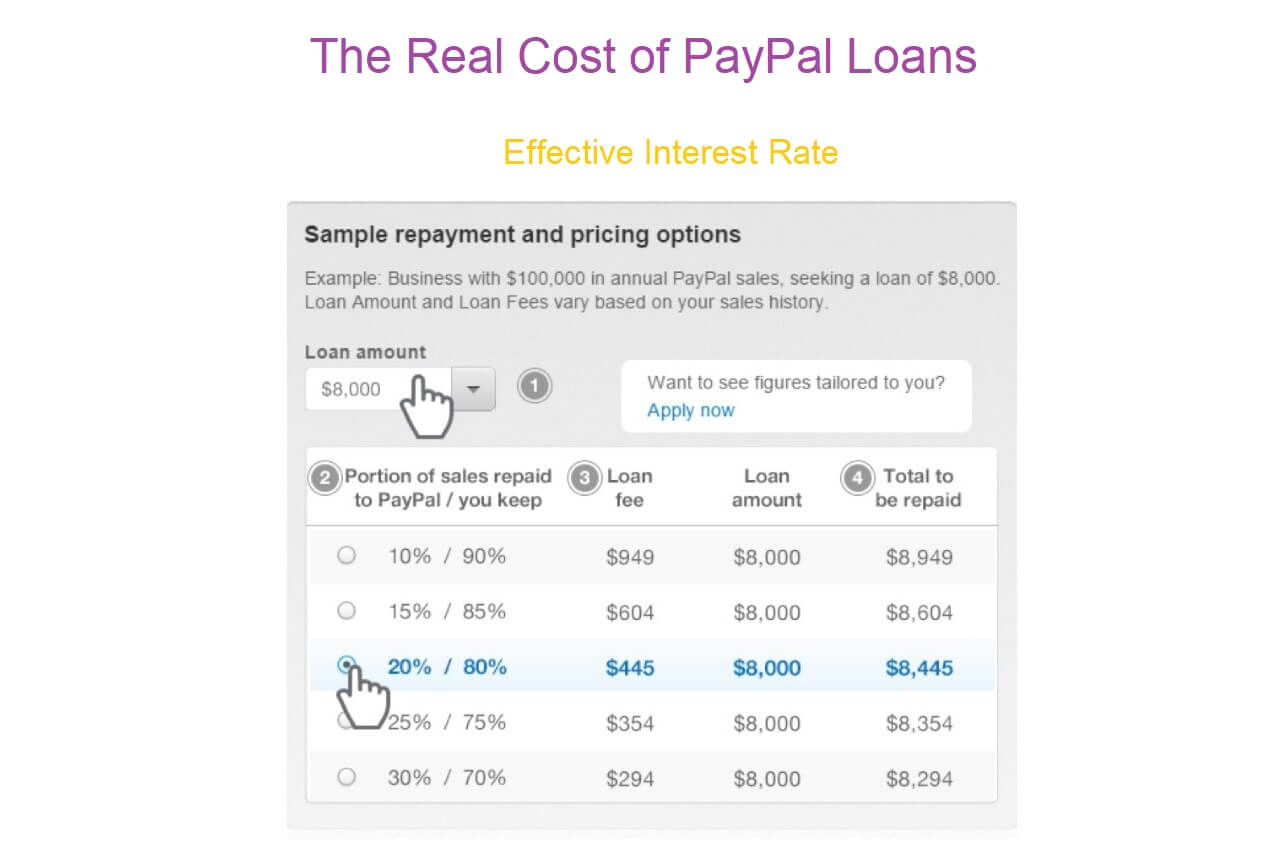

Are you planning on taking a PayPal loan but a little confused by what the interest rate is. You are not alone. PayPal has been very aggressively promoting fixed cost business loans to its business account holders. PayPal has a fixed cost associated with the amount you are withdrawing and a fixed repayment plan. For example, you may borrow $8000 and PayPal will tell you upfront that to borrow $8000, you have to pay a fee of $900 and that will be deducted from your earnings till paid in full. You can opt for 10% or 20% or higher deductions from your earnings and the fixed fee changes accordingly.

What causes the confusion is there is no explanation of what the fixed fee translates to in terms of APR. Most people are much more familiar with interest rates commonly referred to as annual percentage rate or APR.

The financial services firm NAV has come up with a calculator to help you figure out the APR for PayPal loans as well as other similar fixed cost merchant loans. Work with the calculator below and see if that helps you figure out the APR for your loan.

No comments yet.